[Weekly funding roundup April 3-7] Venture inflow sees sharp spike

![[Weekly funding roundup April 3-7] Venture inflow sees sharp spike [Weekly funding roundup April 3-7] Venture inflow sees sharp spike](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-roundup-1670592545805.png?fm=png&auto=format)

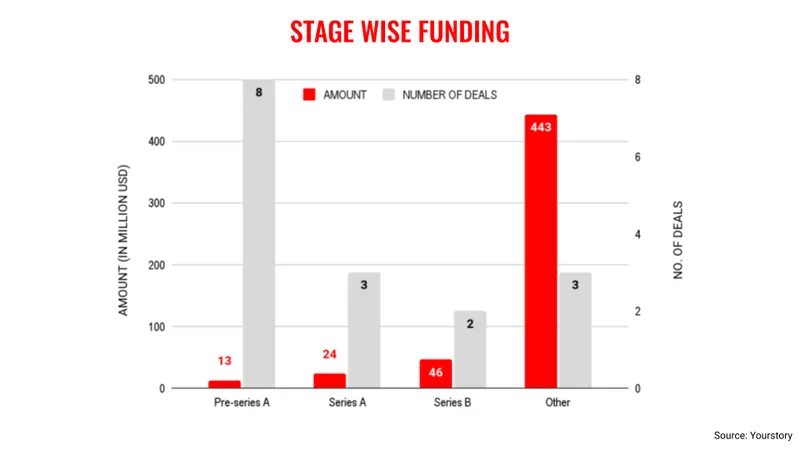

The first week of April saw a sharp rise in venture funding in Indian startups, boosted by a single transaction, as the early-stage category of investments continue to get maximum traction from investors.

The week received $525 million of venture funding, with DMI Finance providing the lift to the overall amount. In comparison, the previous week saw VC funding of $104 million.

Venture funding in startups still remains in a challenging environment and any sharp rise in the amount on a weekly basis is largely due to a single transaction. It is to be noted that only well-run startups will continue to attract a higher quantum of money from investors.

Industry observers believe it is quite unlikely that there will be any sharp recovery in the inflow of venture funding this year, given the macroeconomic environment where various uncertainties still prevail.

The only category of startups that continues to get the strongest traction from the investor community is the very early stage segment. VCs do not want to miss the opportunity of investing in such startups as they would not like to miss any potential winners two-three years down the line.

Key transactions

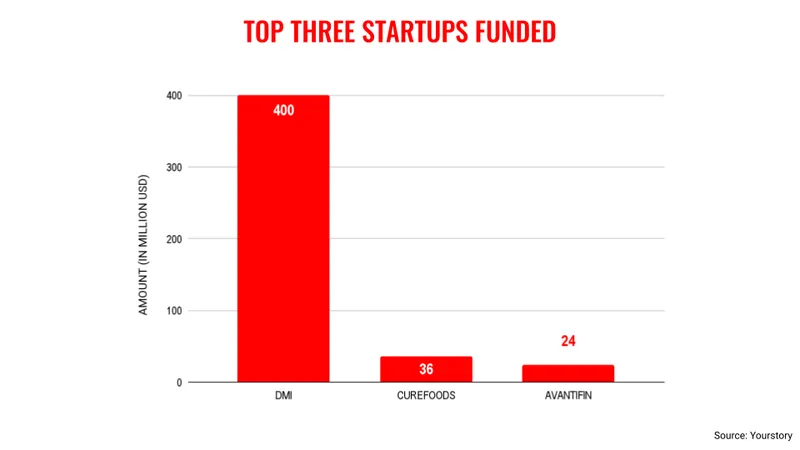

Digital lender DMI Finance raised $400 million from Mitsubishi UFJ Financial Group and Sumitomo Mitsui Trust Bank Limited.

Cloud kitchen startup Curefoods raised $36 million from Three State Ventures, IronPillar, Chiratae Ventures, ASK Finance, and Winter Capital.

Avanti Finance raised $24 million from Rabo Partnerships, IDH Farmfit Fund, Oikocredit, and NRJN Trust.

E-mobility startup Magenta Mobility raised $22 million from bp and Morgan Stanley India Infrastructure.

SaaS startup Spendflo raised $11 million from Prosus Ventures and Accel.

Telematics startup Lightmetrics raised $8.5 million in a funding round led by Sequoia Capital India.

Tech startup Dozee raised $6 million from State Bank of India, J&A Partners Family office, and Dinesh Mody Ventures.

Zero Cow Factory raised $4 million from Green Frontier Capital, GVFL, Pi Ventures, and Pascual Innoventures.

Atul Tiwari is a seasoned journalist at Mumbai Times, specializing in city news, culture, and human-interest stories. With a knack for uncovering compelling narratives, Atul brings Mumbai’s vibrant spirit to life through his writing.