Interest-Free Payment Plan for Users

Apple has announced the introduction of Apple Pay Later, an innovative payment solution designed to enhance users’ financial health. The feature enables users to split purchases into four interest-free payments over six weeks. Initially available to select users in the United States, Apple plans to expand the service to all eligible users in the coming months.

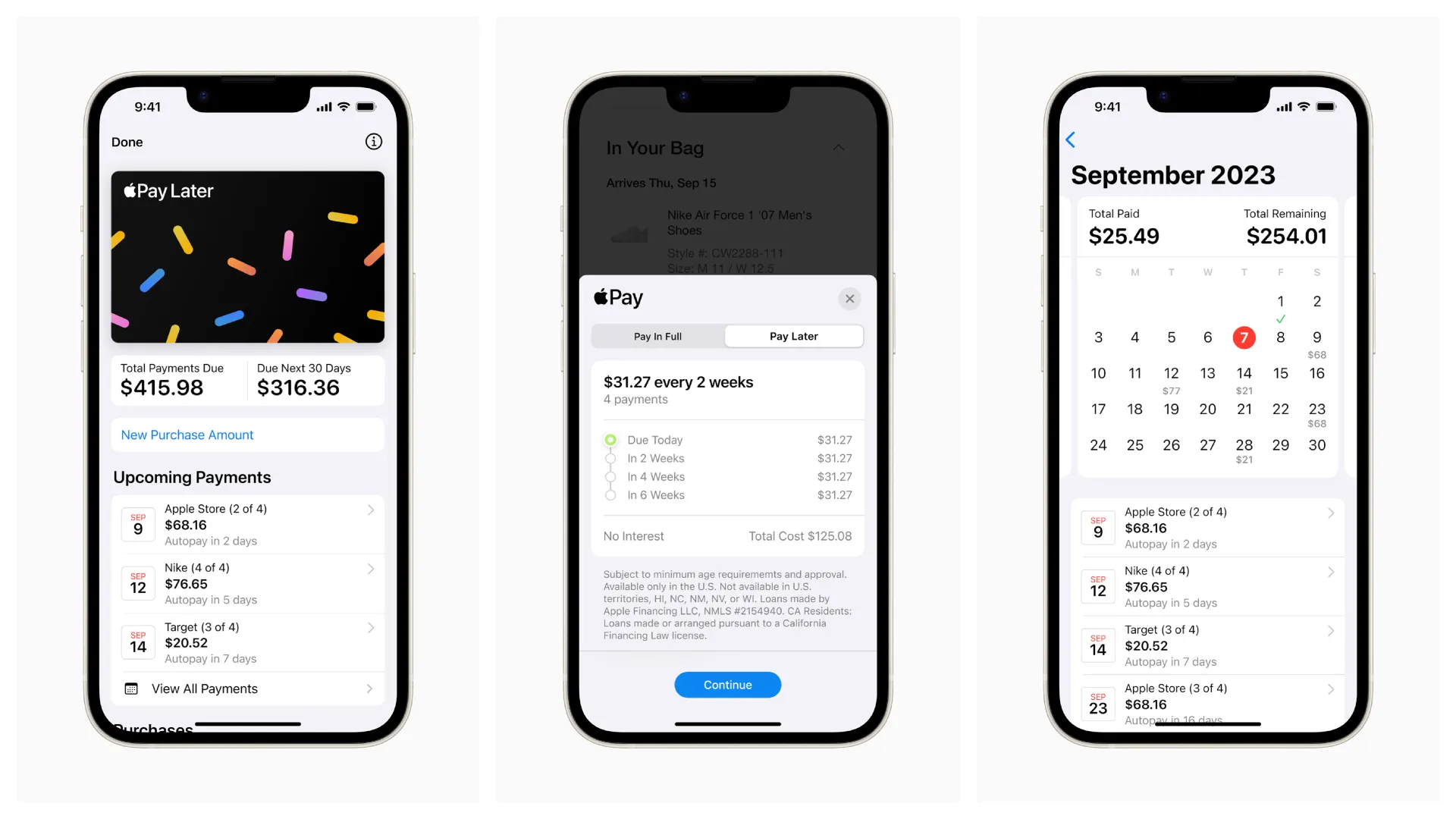

Apple Pay Later allows customers to apply for loans between $50 and $1,000 for online and in-app purchases made through iPhone and iPad with merchants that accept Apple Pay. Jennifer Bailey, Apple’s Vice President of Apple Pay and Apple Wallet, highlighted the flexibility of the new payment option, stating that it was “designed with our users’ financial health in mind, so it has no fees and no interest.”

Users can apply for loans within the Wallet app without impacting their credit. A soft credit pull during the application process ensures users are in a good financial position before taking on the loan. Once approved, the Pay Later option appears when Apple Pay is selected at checkout.

Apple Pay Later is currently available for users with an invite, which is sent out randomly. The service can be used for online and in-app purchases on iPhones and iPads running iOS 16.4 and iPadOS 16.4.

Users can manage their loans within the Wallet app, easily tracking total amounts due and upcoming payments. Notifications and email reminders help users plan for upcoming payments, and only debit cards are accepted for loan repayments to prevent further debt accumulation.

Apple Pay Later is built on privacy and security, requiring Face ID, Touch ID, or passcode authentication, with transaction and loan history never shared or sold to third parties. Apple Financing LLC, a subsidiary of Apple Inc., oversees credit assessment and lending, with plans to report Apple Pay Later loans to U.S. credit bureaus starting this fall.

The new payment solution is enabled through the Mastercard Installments program, ensuring that merchants already accepting Apple Pay do not need to make any additional changes. Goldman Sachs is the issuer of the Mastercard payment credential used for Apple Pay Later purchases.

Back in 2019, Apple launched its inaugural credit service, the Apple Card, specifically tailored for Apple users. Integrated into the Wallet app on iPhones, the Apple Card provides users with a physical metal card and offers a 3% cashback on transactions, accompanied by round-the-clock support and a user-friendly spending overview.

Atul Tiwari is a seasoned journalist at Mumbai Times, specializing in city news, culture, and human-interest stories. With a knack for uncovering compelling narratives, Atul brings Mumbai’s vibrant spirit to life through his writing.