GoI to meet Indian startups impacted by SVB shut down

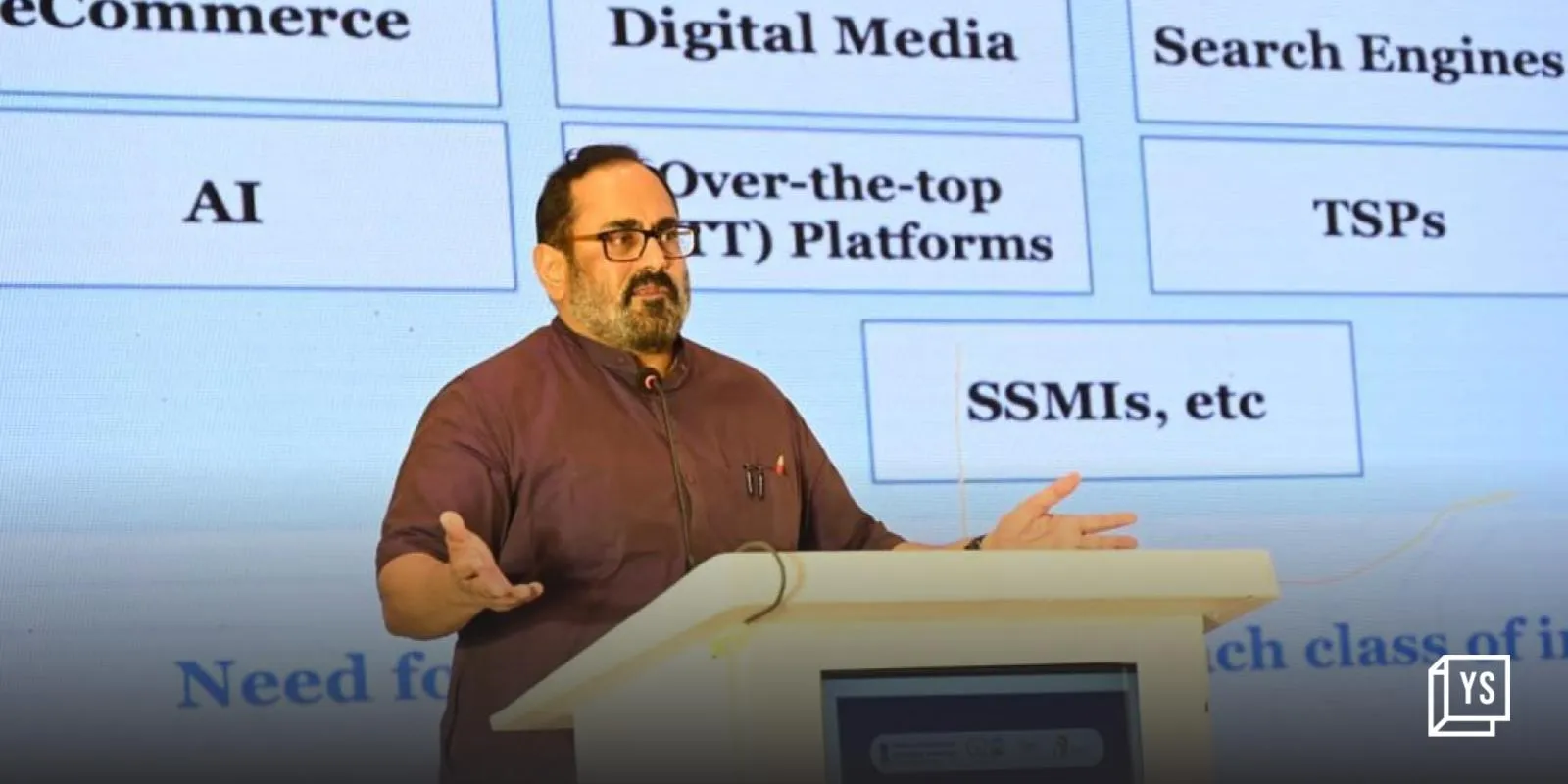

The (SVB) crisis has caught the attention of government officials as multiple Indian startups took to social media channels to air their grievances. Minister of State for Skill Development and Entrepreneurship and Electronics and Information Technology, Rajeev Chandrasekhar on Sunday acknowledged the impact on Indian startups.

“The @SVB_Financial closure is certainly disrupting startups across world. Startups are an imp part of #NewIndia Economy. I will meet wth Indian Startups this week to understand impact on thm n how Narendra Modi govt can help durng this crisis (sic),” he said on social media platform Twitter.

SVB, the US-based banker to venture capital and private equity funds, startups and technology companies was shut down by California regulators on March 10 as it lost nearly 60% market capitalisation following an announcement to sell $1.75 billion worth of shares. The Federal Deposit Insurance Corporation (FDIC) has taken over as the receiver and said that account holders can withdraw up to $250,000, subject to the balance in their account.

Meanwhile, Indian startups with US parent entities took to social media to highlight how the cap on withdrawals from their SVB accounts will lead to liquidity and a working capital crunch, impacting payroll and jobs. Startups which have been a part of startup accelerator programme Y Combinator have also been deeply affected as a significant number of them bank with SVB.

Ahead of the closure of the bank, multiple venture capital and private equity firms had issued advisories to their portfolio companies to withdraw money from their SVB accounts.

Atul Tiwari is a seasoned journalist at Mumbai Times, specializing in city news, culture, and human-interest stories. With a knack for uncovering compelling narratives, Atul brings Mumbai’s vibrant spirit to life through his writing.