Are Stocks A Good Buy Now – Or A Good Bye ??

Three Things To Consider When Considering Whether To Be Bullish or Bearish on the SPY.

Stocks continue to climb higher on the back of earnings that have beaten expectations so far (albeit lowered expectations). The NASDAQ 100 just closed at the highest level since last August. The S&P 500 (SPY) is on the brink of a breakout above $4200. The VIX just closed below 16 for the first time in well over a year.

Whether or not stock markets rip even higher remains to be seen. Momentum can certainly take prices beyond reasonable levels and to extremes.

To quote Keynes- “Markets can remain irrational longer than investors can remain solvent”. In the short run, markets can and will do almost anything.

Over a little longer-term horizon, however, three things are worth considering before you consider getting long stocks at these levels. Let’s look back to about a year ago (11 months) when the S&P 500 was at a similar price to see what has changed in that time frame.

Implied Volatility

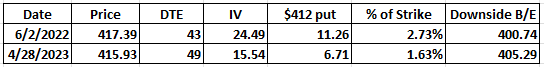

The two option montages below show option prices from Friday’s close and from the close on June 2, 2022.

Back on June 2, 2002, the SPY closed at $417.39. Friday it finished at $415.93, so pretty much the same price as Friday, just a touch lower (0.35%) now.

The June 16, 2023, options have 49 days to expiration (DTE). The July 15, 2022, options have 43 DTE. So, a little longer (6 days) for the 2023 options now.

Normally, puts that are closer to the money with more time to expiration are more expensive. But because the VIX -or implied volatility (IV) – is at lows, the puts now are actually much less expensive ($6.71 now versus $11.26 then).

All because of the big drop in IV from 24.49 to 15.54. The table below puts the comparison together, along with a % of strike (option price /$412 strike price) and downside breakeven ($412 strike price -option price).

So, a much lower cost for much better protection. Kind of like paying less insurance premium for a lower deductible with the exact same coverage.

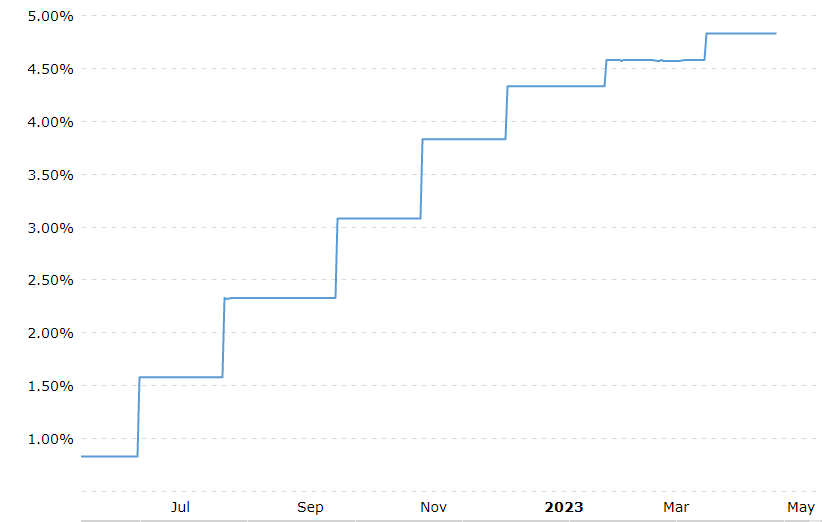

Interest Rates

10-year Treasury yield was 2.913% on June 2, 2022. Friday it closed at 3.452%.

Fed Funds rate was under 1% back then, approaching 5% now.

No doubt interest rates have risen sharply over the past 11 months.

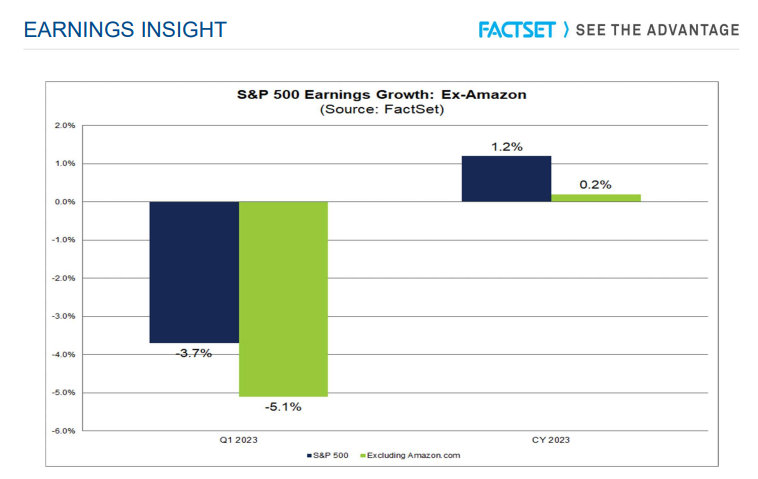

Valuations

P/E was 21.51 June 2, 2022. P/E today is 24.14.-and nearing the richest multiple since December 2021. The last time it was above 24 was February 2 of this year which coincided with a significant top in the S&P 500.

FactSet mentioned that it is interesting to note that Amazon.com is also the largest contributor to earnings growth for the entire S&P 500 for Q1 and 2023. If this company were excluded, the (blended) earnings decline for the S&P 500 for Q1 2023 would increase to -5.1% from -3.7%, while the estimated earnings growth rate for the S&P 500 for CY 2023 would fall to 0.2% from 1.2%. Either way, earnings are still receding and don’t look to see much growth over the next few quarters.

Increased interest rates and lower earnings should lead to lower valuation multiples-and lower stock prices. Instead, stock markets are back approaching fresh new multi-year highs on valuation and all-time highs on price.

The belief in the Fed to start lowering rates sooner than projected and earnings to start improving more quickly than expected requires a pretty good leap of faith.

Traders and investors alike may want to hedge that faith a little. Buying some downside protection with puts that are the cheapest they have been in a long time makes a lot of sense – everything considered.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

SPY shares closed at $415.93 on Friday, up $3.52 (+0.85%). Year-to-date, SPY has gained 9.17%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader.

Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post Are Stocks A Good Buy Now – Or A Good Bye ?? appeared first on StockNews.com

Atul Tiwari is a seasoned journalist at Mumbai Times, specializing in city news, culture, and human-interest stories. With a knack for uncovering compelling narratives, Atul brings Mumbai’s vibrant spirit to life through his writing.