As financial irregularities shake the startup ecosystem, investors rush to set the house in order

Last week, the investors of Bengaluru-based healthtech startup , including , , and , flagged financial irregularities at the company, which came to light during a financial audit.

This development came close on the heels of layoffs at the company—in which 170 employees were let go, as part of what Mojocare called a transition to a more sustainable business model.

While the company denied the allegations, the investors’ intervention indicates that all is not well at Mojocare.

Mojocare is just one of the many startups that have been in the news recently for all the wrong reasons.

In May last year, business-to-business ecommerce company was under the lens for malpractices. Instances of financial mismanagement and failure to adhere to corporate governance standards have since then been reported across several startups, including social media app , car services platform , and, more recently, -backed proptech company 4B Networks. Fintech startup BharatPe too was in the news for related party transactions.

Good governance as a practice takes a backseat when there is a growth-at-all-costs mindset. Investors are increasingly realising this and attempting to put the house in order with strict vigilance measures and more checks and balances.

Recent incidents in the startup ecosystem in the country have led investors to ramp up diligence and exercise their right to information and investigation, as part of the shareholder agreement in portfolio companies.

Investors are also asking for additional reps and warranties, before writing a cheque, and insisting on quarterly reports of financial performance, depending on the terms of the shareholding agreement. Although quarterly reporting is a routine procedure, it was often overlooked for growth companies.

The scrutiny is tighter in the case of early-stage companies where investors are essentially betting on the idea and the founding team and have little to no information on who the potential customers are and what kind of scale the startup could see. Institutional investors have also intensified review of potential investments on legal, financial and taxation aspects.

The founder of a pre-seed stage SaaS company shares that his investors had even reached out to the co-founder of his previous company to check on his credentials.

“We now insist on a proper financial diligence to be completed before every material round of financing, irrespective of whether a new incoming investor asks for it or not,” says Rajat Agarwal, Managing Director at .

“Note that these things have happened not just in India but even globally, in normal funding cycles as well. Frauds tend to be intent issues. Hence they need to be prevented before they happen, typically through a robust diligence process,” he adds.

Stretched deals

Greater scrutiny has resulted in a longer due-diligence period and added to the reporting structure for founders. Hence, investment deals are taking longer than usual to be closed.

According to law firms, which are typically engaged after an investor signs a term sheet for the process of due diligence, deals are being closed in three to four months—a far cry from the hyper-funding cycle, soon after the pandemic in 2021, which saw deals being closed in less than two months.

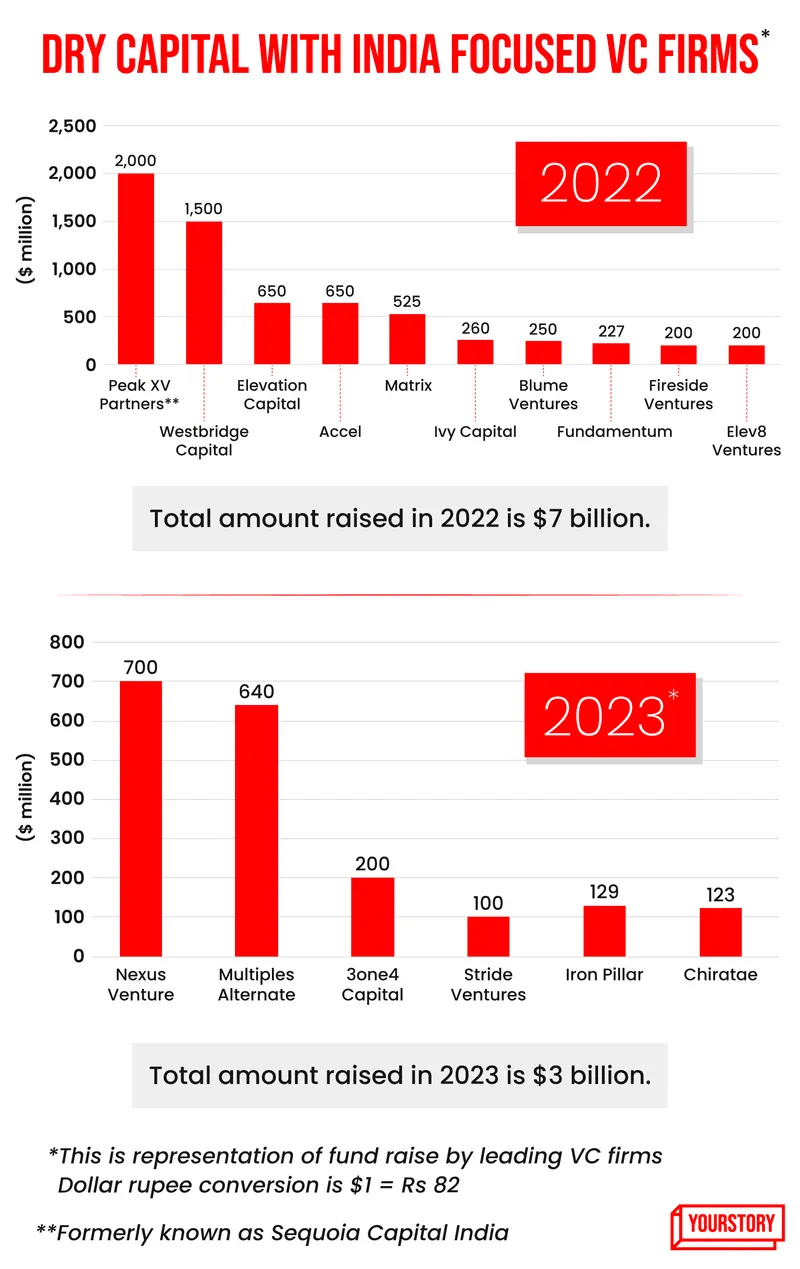

According to YourStory’s research, about $10 billion has been raised by leading venture capital (VC) funds from 2022 till now. The slow deployment of funds and the increased timeline for closing deals are likely to impact founders adversely.

Deployment of funds in 2022 vs 2023

Considering the increased timeline, some investors have started engaging with law firms earlier, ahead of issuing the term-sheet to startups.

“Even before signing a term-sheet, investors are reaching out for limited due-diligence on a few aspects specific to the company (such as structure, regulatory matters, etc). They then decide to sign the term-sheet if the results are favourable, followed by a deeper due diligence. This is something we hadn’t seen much of before in venture deals,” says Sanjay Khan Nagra, Partner at Khaitan and Co.

Need for greater accountability from founders

Due diligence and checks and balances apart, investors on the board expect greater accountability from founders and integrity from promoters.

“Explicit terms are being laid down around the founders’ role and responsibilities on governance and conduct, particularly around dealing with associated parties and around disclosures on personal investments and financial positions,” says Gaganpreet Puri, Managing Director, Risk and Regulatory Leader at management consulting firm, Alvarez and Marsal in India.

Agarwal of Matrix Partners says the VC firm has started setting up regular internal audit functions for portfolio companies of a certain scale to ensure best practices. The findings of these audits are reported to the board periodically.

Spotlight on additional checks and balances

The amount of influence investors wields on founders and promoters depends on their shareholding in the company.

“Only if an investor holds more than 10% share in the company they typically ask for a board seat and might be able to dictate certain terms. It depends on the model the venture capital firm has chosen,” says Prasad Vanga, Founder and CEO of investment and scaling platform Anthill Ventures, adding that one of the biggest challenges that investors face is the regular sharing of information by portfolio companies.

Compliance: Burden or necessity?

Oftentimes, founders find it difficult to implement compliance and corporate governance processes in the early stages of the startup’s journey due to a lack of knowledge of the requirements for filing/compliance and the additional time taken for reporting.

According to the founder of a Series A edtech company with over 10 angels on the cap table, the additional task of sending out performance reports every quarter detracts from focusing on the growth and expansion of the business.

While some founders may view performance reporting as a burden, Swati Bhargava, Co-founder of cashback and rewards platforms CashKaro and EarnKaro, insists regular reporting is a necessity. Founders need to implement this early on so that their processes are well in place for scale-up, she adds.

“In my experience, being transparent with investors builds trust and confidence in the relationship. So I have always sent out our monthly MIS (management information system) to them,” says Bhargava.

The company, which has 400 employees, conducts two external audits a year and quarterly internal audits.

“It does not help to be hands-off about reporting. In the end, founders are accountable, so (they) may as well be involved and ensure everything stays on track,” says Bhargava, stressing the need for founder accountability.

Recourse in case of malpractice

What happens when there is financial fraud or irregularity in the firm? What is the recourse for investors?

Depending on the terms of the shareholders agreement, there are a few options for investors—such as revising business plans/changing the business model, conducting an external audit, and revising control of the company by bringing a non-promoter CEO or leader to run operations.

In case of a loan default (by the founder), the founder has to facilitate the exit of existing investors by finding another investor or buying back the loan. Founders can also buy shares using personal wealth or the put and drag options, which allow founders’ shares to be sold to another party.

Dry capital available with leading VC firms

“Subject to the size of the deal, investors look at exits by bringing in a strategic investor or finding a company interested in buying out the startup. These deals have to be structured appropriately from a legal and tax standpoint to ensure that the shareholders get an exit and the acquirer gets the benefit with least liability,” advises Rashi Saraf, Partner at IndusLaw.

Legal recourse is another option—investors can sue, file a case of fraud, or explore other provisions of the company law, but very few VC firms opt for this.

This is because most firms would like to be perceived as a founder-friendly fund, says an investment banker, on the condition of anonymity.

Also, the cost of pursuing the matter in court can often outweigh the investors’ return on investment.

Good governance is imperative

The bottom line is good governance is no longer a matter of choice, it is an imperative that keeps in mind the interests of all stakeholders.

“Governance mistakes and lapses may happen early but may get detected only when there is scale, financial monitoring, or additional oversight, owing to an increased size or relevance of the company. Easier access to funds, lesser oversight on ‘cash burns’ and trust without verification can drive failure at any stage,” says Puri of management consulting firm, Alvarez and Marsal.

While investors can double down on vigilance, at the end of the day, the buck stops with the founders—who have to ensure adherence to governance practices and prevent lapses. Therefore, they must create an organisational ethos that rests on the foundation of accountability and honesty and foster an environment where both innovation and integrity matter.

(Cover image and infographics by Winona Laisram)

Atul Tiwari is a seasoned journalist at Mumbai Times, specializing in city news, culture, and human-interest stories. With a knack for uncovering compelling narratives, Atul brings Mumbai’s vibrant spirit to life through his writing.