VC funding down 60% to $971M in April

Venture capital (VC) funding into Indian startups saw a 60% decline in April. For the second time in 2023, the total capital inflow was below the crucial mark of $1 billion on a monthly basis.

The VC funding for April 2023 was at $971 million compared to $2.4 billion in April 2022. The funding saw a decline of 31% on a month-on-month basis when compared to March 2023.

This fall in VC funding reveals the challenges faced by the Indian startup ecosystem while raising capital and the cautiousness shown by investors. It is unlikely that this environment will change anytime soon.

However, PhonePe and DMI managed to raise an amount in the range of $100 million and above in April. Barring these two startups, no other startup managed to raise this amount in the last month. The other high value transactions during this period were in the range of $30 million – $70 million.

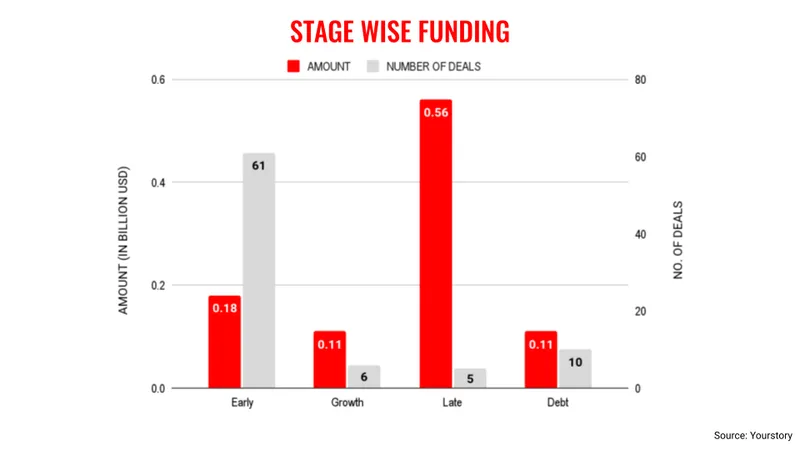

In terms of stage-wise transactions, the late-stage category saw the highest value at $566 million, spread across just five deals. However, the highest volume of activity was in the early-stage category, which raised $181 million across 61 deals.

This has actually been the trend ever since the funding slowdown started, where investors have been largely focused on the early-stage category of startup investment. Here, the volume of activity is high, but the amount of money is considerably less.

Fintech emerged as the leading sector that received the highest amount of funding for April at $585 million, followed by hyperlocal at $81 million and logistics at $53 million.

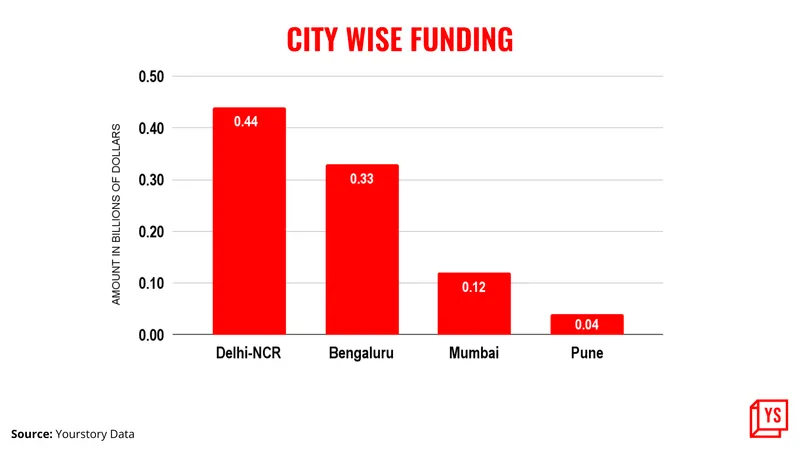

In terms of the cities that received the biggest share of venture funding, Delhi-NCR once again emerged as the leading city with $442 million, followed by Bengaluru at $339 million and Mumbai at $123 million.

The month also saw 12 mergers & acquisitions (M&A), cutting across segments such as edtech and fintech.

The first four months of the year have shown an uneven pattern in terms of VC fund flow as the months of January and March saw the total amount crossing $1 billion, while in February and April it fell below this mark.

There is no certainty on when there would be a steady pickup in the VC inflow into startups. Industry observers believe it is unlikely to happen during the course of this year. Any strong activity is likely only in 2024.

Atul Tiwari is a seasoned journalist at Mumbai Times, specializing in city news, culture, and human-interest stories. With a knack for uncovering compelling narratives, Atul brings Mumbai’s vibrant spirit to life through his writing.